- #Property evaluator app review registration#

- #Property evaluator app review code#

- #Property evaluator app review license#

What to do when you lose your 401(k) match Should you accept an early retirement offer? If you require a translator for your visit, please contact the Taxpayer Liaison Officer before your visit so that we can ensure we have someone to assist you.How much should you contribute to your 401(k)? Please feel free to contact our office if you have any questions. After contact is made or it is established that nobody is available at the property, we will conduct our inspection of the exterior of the property. Should the property owner or resident be away, we will leave a door hanger and a business card on the front door.

#Property evaluator app review registration#

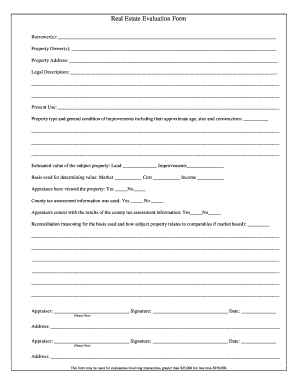

Each appraiser will have the following identification items with them at all times pictured ID, business card, and a Texas Department of Licensing and Registration (TDLR) registration card. Our protocol is to attempt to make the property owner or resident aware by ringing the doorbell or by knocking on the front door to identify ourselves. We will be conducting on-site inspections of residential properties, which will include updating our property photographs. The Gregg Appraisal District will begin its reappraisal on residential properties starting July 2022 to March 2023. Please contact the Gregg Appraisal District at 90 for any questions you may have concerning the qualifications for homestead exemptions.

#Property evaluator app review license#

You must furnish a copy of a valid Texas driver’s license or State ID and the address on the license must be the same for which the homestead exemption being applied.You and your spouse do not claim a residence homestead exemption on another property.

You own and occupy your home on the date you request the exemption.Mark A Cormier, Chief Appraiser RPA, CCA, CTA

We are dedicated to serving the citizens of Gregg County while ensuring that property valuation in our county is fair, equal, and uniform. Information regarding specific properties within the district is also available as allowed by law. Welcome to our website, I hope that you will find general information helpful about the District and the ad valorem property tax system.

#Property evaluator app review code#

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices (USPAP). Gregg Appraisal District is responsible for appraising all real and business personal property within Gregg County. Gladewater 90 Welcome to Gregg County Appraisal District! If you have not received your tax statement by November 1 or have any questions regarding your tax statement, please contact your tax assessors’ office. Please visit the online forms section of our website to fill out a homestead application.Ģ022 Tax Statements will begin being mailed in October. ***SCAM ALERT*** PLEASE NOTE: Filing a homestead application with Gregg Appraisal District is always free. Gregg County Appraisal District Mission Statement: Courteously and respectfully serve the public and its entities by providing an equal and uniform appraisal roll in an accurate and timely manner.

0 kommentar(er)

0 kommentar(er)